Snapshot

I designed and won a $5m, 3-year program that connects

informal rural savings and loan groups to formal credit

unions with digital finance tools. Officially launched

in January 2017, I worked with USAID, local financial

institutions, our staff in Haiti, finance experts, and

colleagues in DC to co-create the Haiti Accessible

Finance Activity.

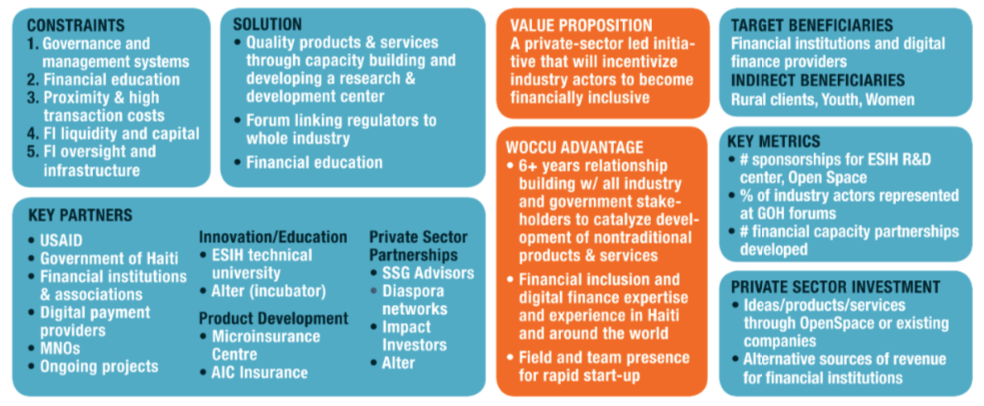

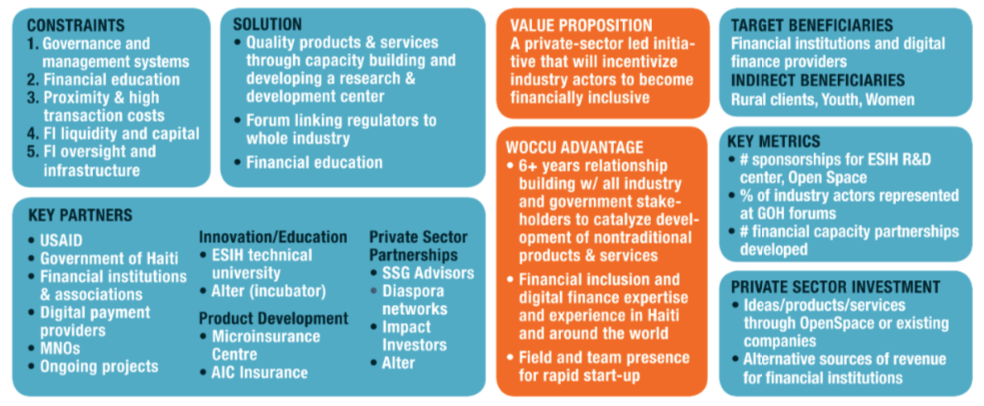

Strategy

Responding to donor requests are challenging - they expect

a detailed program and program team within a short span of

time. I always begin by trying to understand what we need to

learn. To help guide me through this, I developed a

project development canvas

- my take on the business model canvas. It keeps

me focused on defining the challenge or constraints, value

proposition, my company’s advantages, beneficiaries,

key partners, key metrics, and potential private-sector

partners that can contribute to the project.

Initially, I create a list composed of my guiding principles

and questions I want to be answered. For this project, my

list was short:

- The project has to be organic to ensure sustainability.

Haiti has a long history of failed projects and corruption.

I wanted to focus on something that was already created

by Haitians.

- Why weren’t financial services reaching rural areas?

- How much innovation was the client comfortable with?

Our main goal was to create a project that was organic, rather

than forcing something new while crossing our fingers hoping

it would work. Since we had been working in Haiti for more

than 9 years, I had a good understanding of the financial

system, both formal and informal. So, we wanted to work with

existing, yet informal, savings and lending groups in rural

Haiti to transform them into formal groups. Credit unions are

modeled similarly to these rural groups and WOCCU has a time-

tested model called field officer banking that incorporates

groups into their membership while creating individual accounts

- allowing for individual and group services. And most importantly,

it allows individuals to develop a relationship with formal

financial institutions, creating access to products and services

they had not had before.

Research

I tend to enjoy this part the most because it brings me

out to the field to meet the direct and indirect beneficiaries.

First, I conducted a thorough literature review,

compiling questions and creating brainstorming notes.

I used these notes to figure out who I should meet with

while in the country vs virtually as well as to create a

list of guiding questions for the interviews.

In Haiti, I conducted around 15 interviews over 2 weeks

and held brainstorming sessions with WOCCU’s staff in Haiti.

The interviews were with the client (USAID), other donors

in the country, potential competitors, NGOs conducting

similar or complementary programs, government officials,

local bankers, telecommunications operators, fintech

companies, and an incubator.

What I learned:

- Competitive Landscape: It was a crowded field.

Almost every organization working in financial

services was bidding on the program. We had to

highlight our advantage and value proposition over them.

- Digital finance regulation was improving, albeit slowly.

- Lack of connection between regulators and what was

happening on the ground.

- Financial institutions were afraid to provide

services and products to rural households due to a

perceived risk.

- Limited knowledge of finance and the use of cell

phones could hinder fintech growth.

- Small business growth was limited, as was the drive

to innovate and create in the financial sector.

From these insights, we knew we had to focus on the following:

- Value proposition of our project: private-sector

led & incentive-based

- WOCCU's advantage: 9+ years in Haiti with a great

reputation with the client and trusting relationship

with local stakeholders

Prototype & Test

July-August 2015: Submission of EOI that proposed 4

different interventions (as written in the project model canvas)

- Continue to improve the quality and availability

of products and services by building institutional

capacity and fostering innovation through private-sector

partnerships. Within institutions, we will improve

their governance and upgrade their management systems,

as well as develop their internal capacities to respond

to client needs through product and service development,

while remaining or becoming profitable;

- Leveraging and creating entrepreneurial talent in

Haiti by partnering with Ecole Superieure d’Infotronique

d’Haiti (ESIH) university to facilitate new ideas for

meeting financial services challenges;

- Create a forum linking GOH to the industry to

better understand on-the-ground realities and needs; and,

- Provide financial capacity training and tools for

financial institution employees and potential borrowers

in partnership with stakeholders and ongoing projects.

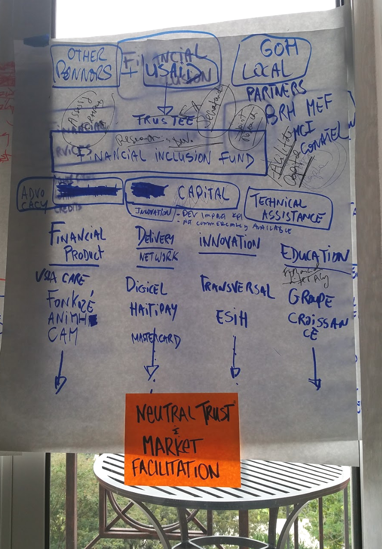

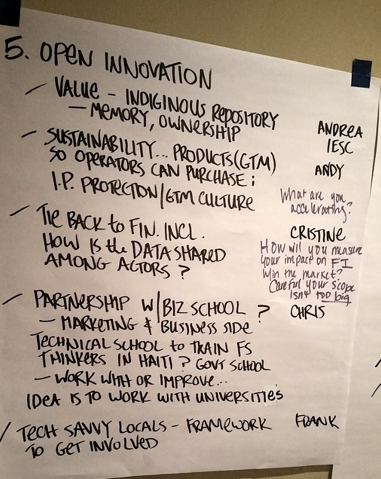

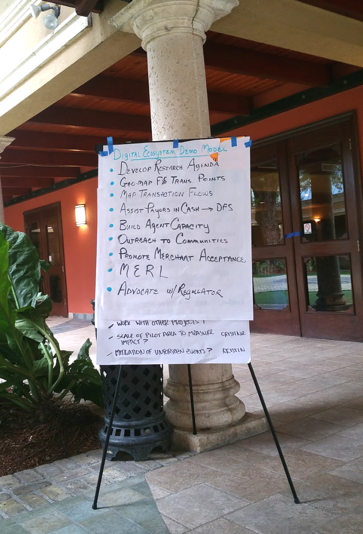

December 2015: 3-day workshop hosted by USAID Haiti

in Port-au-Prince.

The workshop was similar to a trade fair: Each competitor

had an easel pad and five minutes to showcase their ideas.

Then the client and competitors perused the presentations

and asked questions. At this stage, we made a strategic

decision to join forces with our competitor to create sister

programs that complemented one another. During the workshop,

we held brainstorming sessions in our hotel rooms.

See the image with paper taped to the window.

January 2016-August 2017: 5-page concept note, then

4 iterations of the full technical proposal. This included a

full staff, budget, activities, and partners. And each

iteration was completed within 24 hours to 4 weeks, depending

on the client’s request.

Finalize & Launch

We launched the program soon after signing our award in

January 2017. I continually monitored its progress, taking

note of the tweaks program managers made in order to add

improvements to the design process. If you'd like to read

more on the project, this is the

project site.

Learnings

This experience taught me a lot about myself and how I lead

proposal teams. Usually, clients give us budgetary and outcome

constraints, which create limitations for our proposal design.

Without restrictions, I lost sight of what we could achieve and

confined our activities to specific issues. Next time, I plan to

think big and add more perspectives during ideation to discuss

multiple viewpoints and reach better conclusions.

Check out other case studies.