Snapshot

I led my group to develop a strategy to increase mobile app engagement, provide additional app benefits, and zero- to low-cost social media and email marketing.

Strategy

Before I began the project, I made note of the guiding principles:

- No cost

- EBITDA positive

- Increase use of digital payments

- Increase customers’ net promoter score

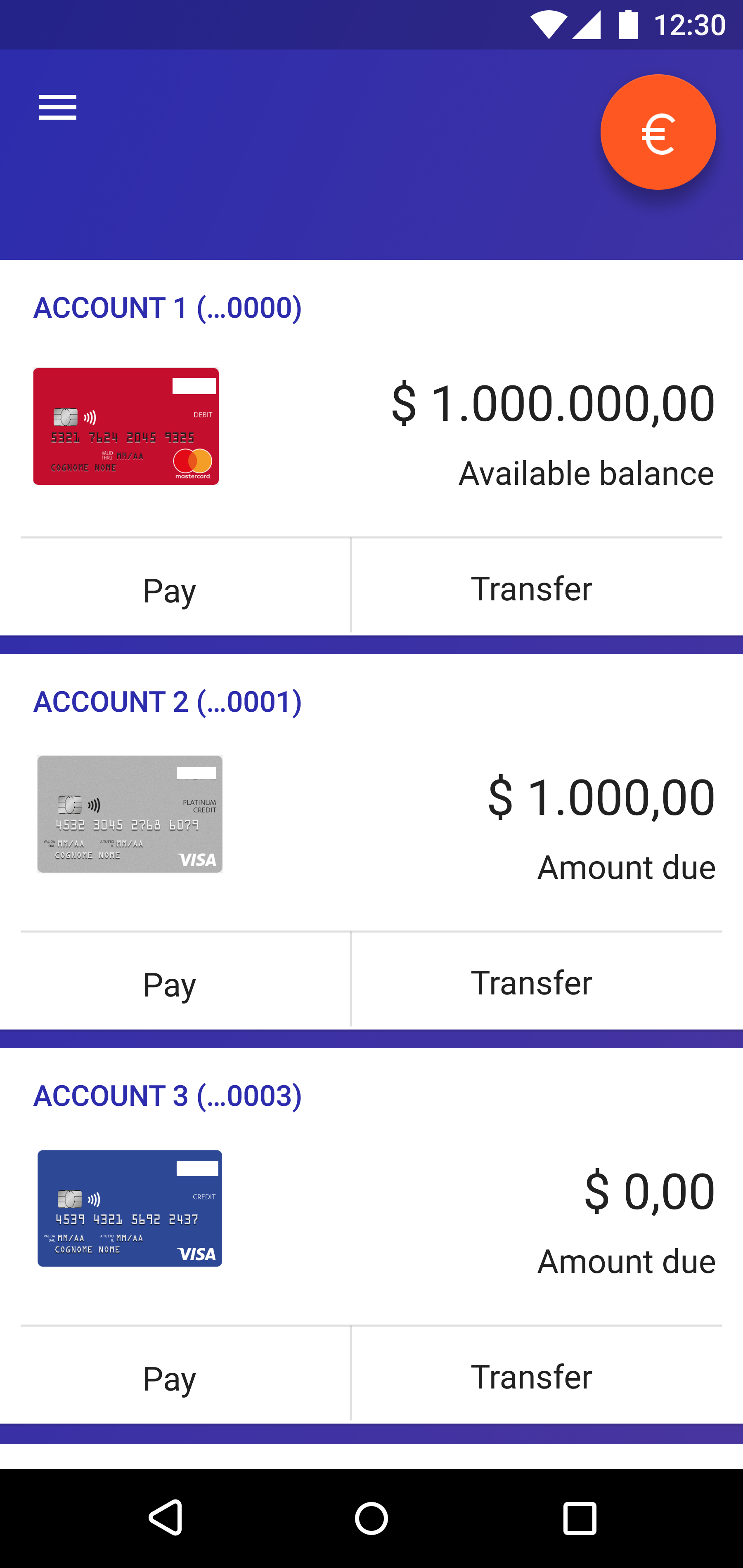

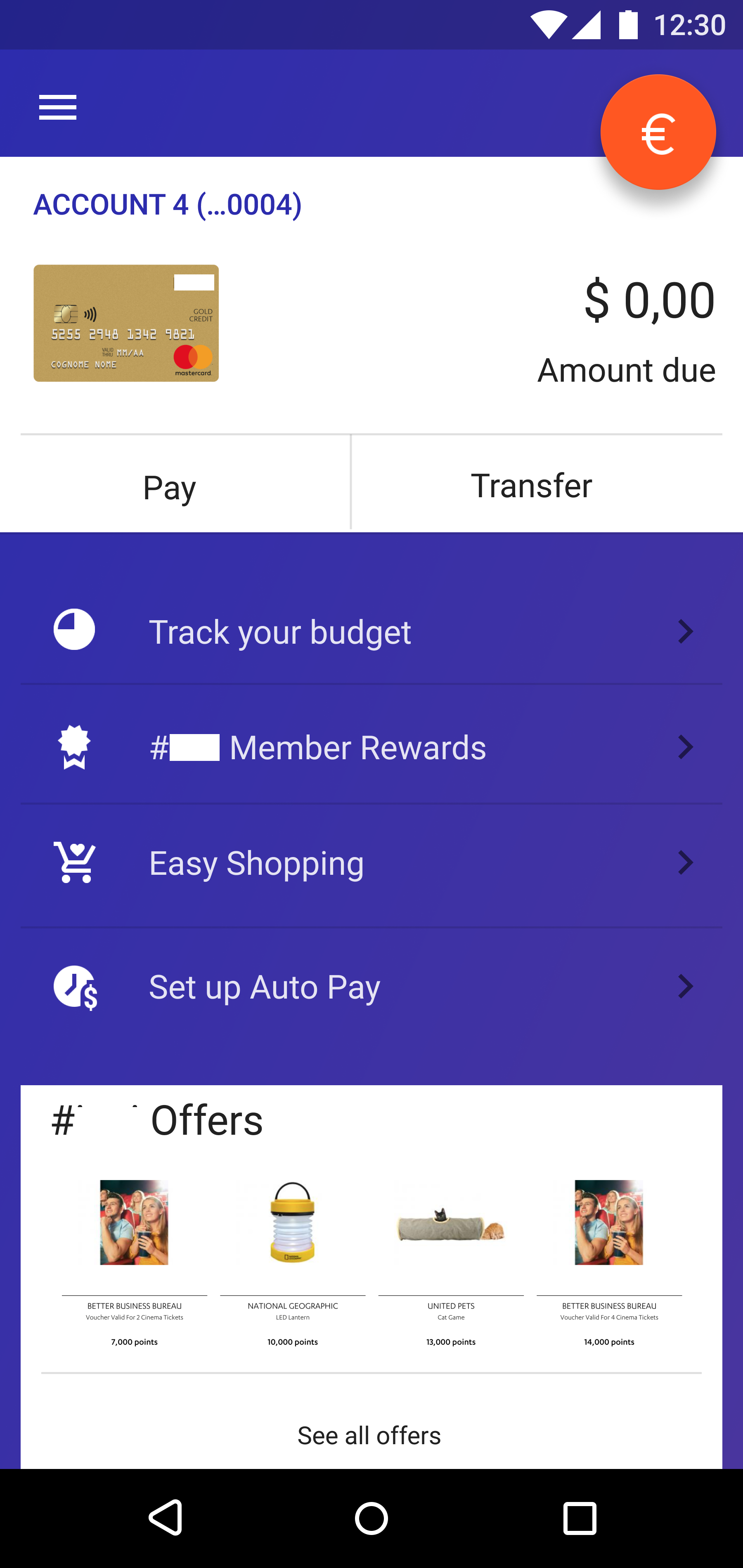

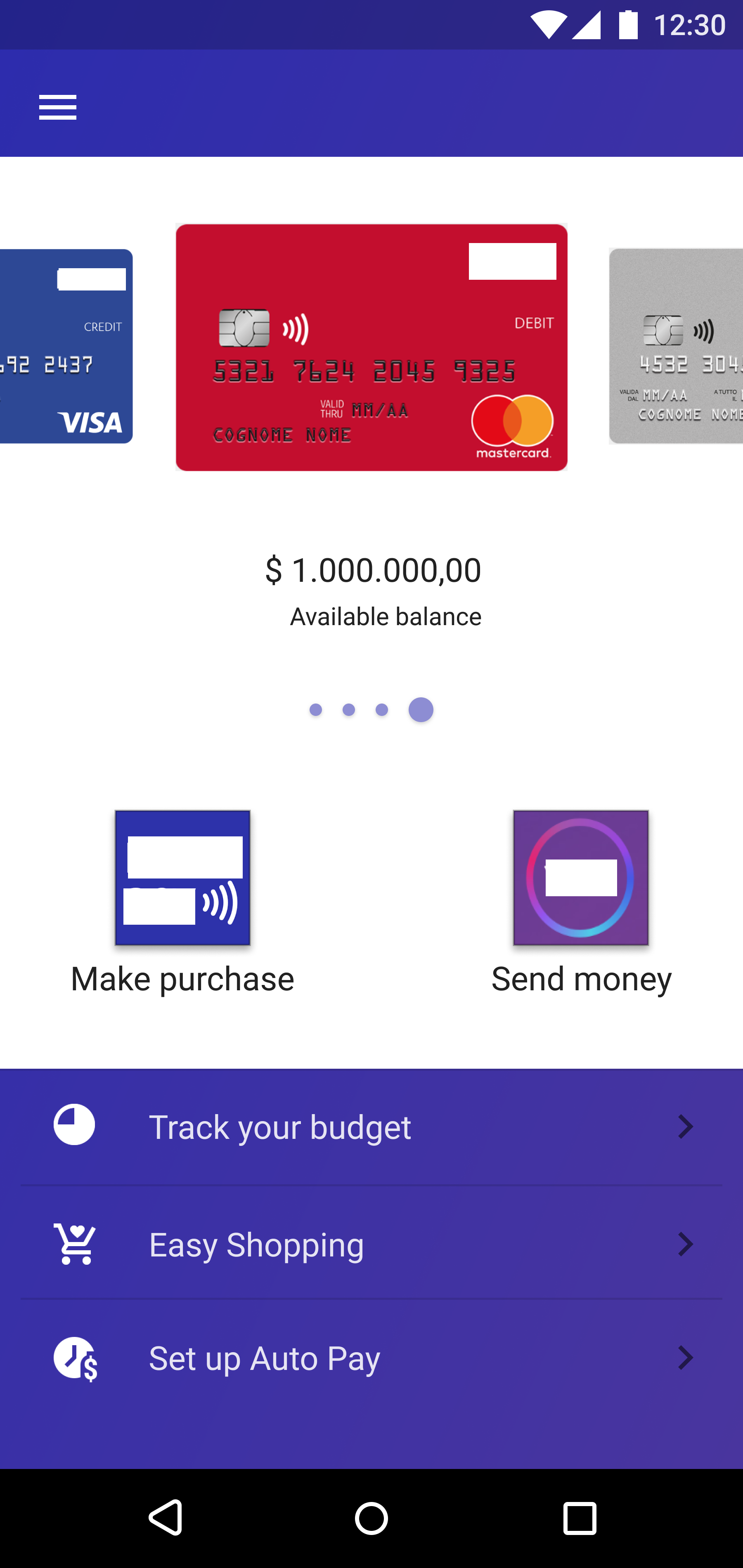

I started by focusing on understanding the company and its apps as well as the market. The client’s business has four different activities: 1) they provide back-end authorization and payment requests, 2) third-party MIS SaaS for banks, which includes support to the banks’ mobile apps, 3) person-to-person (P2P) digital payments, and 4) an application that helps customers manage credit and debit cards, track their budget, make purchases (with interest-free financing at participating stores), and earn rewards. They are seeking help for the fourth product.

Although the app has more than 1 million downloads on Google Play and ranks #14 on the Apple App Store, the users were not active.

They saw Amazon Pay as their main competitor because they provide the customers with the tool to pay online and the merchant with the system to acquire the online payments, albeit with the limitation that - at the time in Italy - they do not work beyond the Amazon website.

Customers and users today: Each product has its own customer base.

- Back-end authorization: Banks and settlement companies

- Third-party SaaS: Banks

- P2P app: Users under 18 years old

- Management app: They were hoping to reach Millennials

Constraints: Other than the financial limitations, a major constraint was the client’s desire to only offer this app to customers who have debit or credit cards affiliated with their company. Partner banks provide cards that are backed by the client’s services and technology, which also meant the app was limited to Italian borders and Italian speakers (wouldn’t be translated).

Research

After the stakeholder interview and research into the company, I started researching the market. Some of the research was provided by the client since they had conducted a thorough investigation. Major insights include:

- Only 26% of Italians use digital payments. Most

people (92% of adults) preferred and used cards.

- Cash-first. Many merchants in Italy prefer cash over

any other type of payment. This may be because it is

an SME dominated economy.

- PayPal is widely used in Italy, however, the

traditional bank is still the most frequently used

payment tool.

This meant that there had to be a larger cultural shift towards trusting and understanding digital banking.

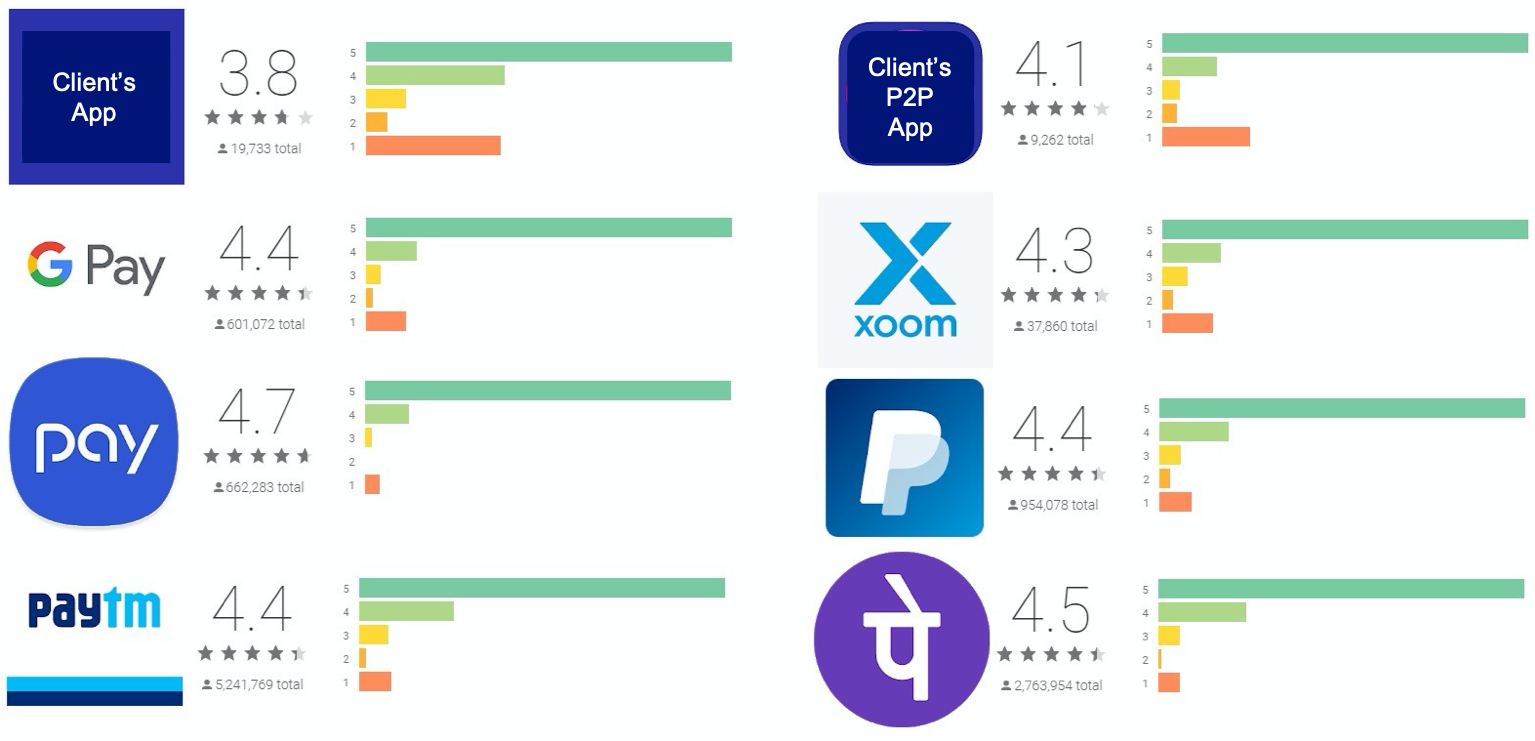

Next, I looked into the management app and the P2P app. I combed through thousands of reviews on Google Play. The Apple Store didn’t allow me to read through the reviews.

What they loved:

- Immediate update of any expense

- Monthly expense summary

- Ease of using multiple cards in 1 app

What can be improved:

- More interactive visuals

- Simpler account creation

- Additional languages

- More autopay subscriptions, like PostePay (post-office)

- Security and customer verification issues

Competitive Landscape

There are a lot of competitors for this application. Luckily, many of them are not as popular in Italy as they are in other countries, and thus provided great idea features for our clients, such as Venmo, Stripe, and Squarespace. Other competitors include: PayPal, AmazonPay, Google/ Apple/ Samsung Pay, Mint.com.

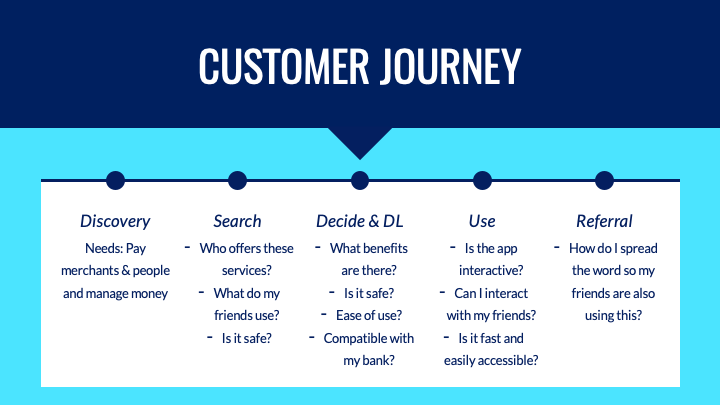

Target Customer: Millennials and GenZ.

Millennials

Bio: College graduate, 25-35, with a stable office job. Loves Instagram. 71% prefer the dentist than listening to what the bank has to say, while 73% would trust a new financial service offered by Google, Amazon, PayPal (big tech players)

Motivations: Connect & socialize

Needs: Things that make her busy life easier. Reviews articles & blogs before making choices.

GenZ

Bio: Digital natives, high school or college student, with an attention span of 8 seconds.

Motivations: Social validation & making a positive impact on the world.

Needs: Interaction with brands & social validation.

Prototype & Test

Based on these insights, we recommended the following:

Mobile App Engagement

- A more user-friendly dashboard & notifications

- Integration of the P2P app into the management app to

provide a complete user experience to a broader segment

Additional benefits

- More promotions for rewards members, such as discounts

and cash-back at partner retailers and for using the

application for payments.

- Additional digital payment options: Poste Pay, reloading metro

card, and loan repay.

- Family budgeting: combine family accounts to track

budgets across family members. The parents can distribute

allowance through the P2P account, while also tracking

spending. This can help incorporate younger members into

the formal financial system and start building credit.

It also creates brand loyalty at a younger age.

Digital Marketing

- Interactive social media campaigns for UGC & viral videos

for free to low-cost marketing content, especially since

social media is widely used by the target segment.

- Gamification: Play games with customers by testing

their finance knowledge with trivia and polls

- Photo competitions #Uso[app name]; “Best 10 second ad

wins!”; “How have we saved your day?”

- Informative email marketing and blog posts on finance

and client offerings to showcase expertise and increase

credibility and trust with customers.

Finalize & Present

We presented the following PowerPoint to our client. We are unsure of whether they incorporated our suggestions, but we did receive a perfect score from the professor. The presentation also included a video prototype of the new application I created on InVision, however, to keep the client's name anonymous, I am just providing the static pages.